Total cash on hand refers to overall amount of readily accessible funds an organization has available. This statistic typically includes liquid assets as well as physical currency. It's a vital metric essential for budgeting, providing insight into a company's short-term liquidity.

Controlling Your Total Cash Flow

Effectively managing your total cash flow is essential for the long-term prosperity of any enterprise. It involves a thorough understanding of both your incoming and outgoing capital. Regularly reviewing your cash flow statement can uncover areas where you can improve your financial performance. By utilizing sound cash flow practices, you can ensure the longevity of your operation.

- Establish a detailed budget that distributes funds to diverse segments.

- Record all your income and expenditures meticulously.

- Forecast future cash flow trends to anticipate potential shortfalls.

Amplifying Total Cash Reserves

To successfully chart the often-volatile waters of finance, businesses must emphasize building robust total cash reserves. A healthy cash reserve serves as a vital buffer against unforeseen costs, allowing companies here to weather economic fluctuations. Thoughtfully managing your cash flow and utilizing sound financial techniques are essential for maximizing your total cash reserves. Consider diversifying your revenue streams, prudently controlling expenditures, and exploit available financing alternatives. By taking a proactive approach to cash management, you can establish a financial foundation that supports both short-term stability and long-term growth.

Understanding Your Cash Position

A company's total cash position illustrates the amount of liquid assets available. It includes all forms of cash and cash equivalents, such as current accounts, short-term deposits, and readily convertible assets. Analyzing a company's total cash position provides valuable insights into its stability. A strong cash position indicates the ability to meet urgent obligations, fund expansion, and survive economic fluctuations.

Reviewing Total Cash Balances

When evaluating a company's financial health, it is essential to examine its total cash balances. This metric provides valuable insights into the company's solvency. A strong cash balance suggests a company's ability to satisfy its short-term liabilities. Examining trends in cash balances over time can highlight upcoming financial challenges or situations.

- Additionally, it is important to consider the environment in which a company operates when evaluating its cash balances.

- For example, a seasonal industry may experience significant variations in cash balances throughout the year.

As a result, a comprehensive evaluation of total cash balances should incorporate multiple elements to provide a complete understanding of a company's financial position.

Tracking Total Cash Transactions

To precisely record total cash transactions, businesses need to implement a robust system. This frequently comprises meticulously documenting all cash inflows and outflows in a centralized location. Keeping accurate records of each transaction, including the date, amount, reason, and relevant details is vital. Regular reconciliation of cash accounts with bank statements helps to identify any discrepancies or potential errors.

, Additionally,Moreover, employing accounting programs can significantly streamline the process and deliver valuable insights into cash flow patterns.

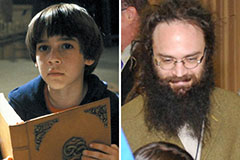

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now!